In today’s dynamic financial landscape, trading has become increasingly accessible, and platforms like Exness Forex & Cfds Exness forex & CFDs are at the forefront of this evolution. Traders now have the opportunity to engage in various financial instruments, particularly Forex and Contracts for Difference (CFDs). In this comprehensive guide, we will delve into what Exness Forex & CFDs entail, how they operate, and effective strategies to maximize trading outcomes.

Understanding Forex Trading

Forex, or foreign exchange, involves trading currency pairs. Each currency pair consists of a base currency and a quote currency. Traders aim to profit from changes in exchange rates between the two currencies. For example, if you expect the Euro (EUR) to strengthen against the US Dollar (USD), you would buy the EUR/USD pair.

Forex is the largest and most liquid financial market globally. It operates 24 hours a day, five days a week, allowing traders to enter and exit positions at their convenience. The primary advantage of Forex trading lies in the high leverage offered by brokers, such as Exness, which enables traders to control larger positions with a relatively small amount of capital.

Exploring CFDs Trading

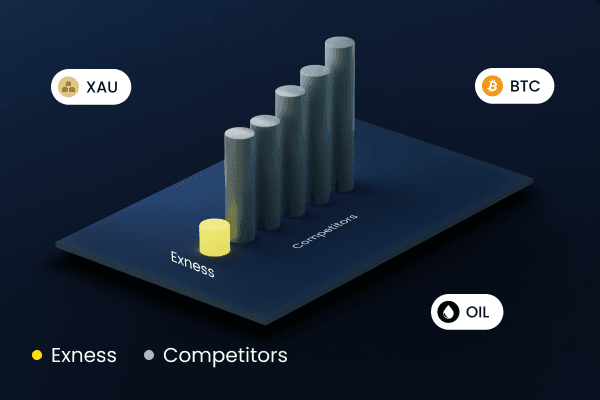

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of various assets without owning the underlying asset. Exness offers a diverse range of CFDs, including commodities, indices, cryptocurrencies, and stocks.

When trading CFDs, you can profit from both rising and falling markets. For instance, if you anticipate that the price of oil will increase, you can open a long position. Conversely, if you believe the price will decline, you can open a short position. The flexibility of CFDs makes them an attractive option for both short-term and long-term traders.

The Role of Exness in Forex & CFDs Trading

Exness is a well-regarded brokerage firm that provides access to multiple financial markets, including Forex and CFDs. Founded in 2008, it has gained a reputable standing due to its user-friendly trading platform, competitive spreads, and robust customer support.

The platform supports various trading accounts tailored to different trading styles and experience levels. Whether you are a seasoned trader or a beginner, Exness has something to offer. Additionally, the availability of both MetaTrader 4 and MetaTrader 5 platforms enhances the trading experience by providing advanced charting tools, technical indicators, and automated trading options.

Benefits of Trading with Exness

Choosing Exness as a trading partner comes with numerous advantages:

- Low Spreads: Exness offers competitive spreads, which can significantly enhance profitability, particularly for high-frequency traders.

- Rapid Withdrawals: Exness is known for its efficient withdrawal process, enabling swift access to your funds, thereby improving liquidity.

- Educational Resources: The broker provides an extensive educational section, including webinars, articles, and tutorials, to help traders enhance their skills.

- Multiple Account Types: With a variety of trading accounts, traders can choose a plan that best fits their strategy and risk tolerance.

- Regulatory Compliance: Exness operates under strict regulations, ensuring a secure trading environment.

Strategic Approaches to Trading Forex & CFDs

Successful trading requires a well-defined strategy. Here are some commonly adopted methods:

1. Technical Analysis

Many traders utilize technical analysis to forecast price movements. This involves analyzing historical price charts and using technical indicators such as moving averages, RSI, and Fibonacci retracement levels. Understanding key support and resistance levels can also guide trading decisions.

2. Fundamental Analysis

Fundamental analysis looks at economic indicators, news events, and geopolitical situations that could impact currency values or CFD prices. Traders who incorporate fundamental analysis often stay updated with financial news and economic reports to make informed trades.

3. Risk Management

Effective risk management is crucial to preserve capital and ensure long-term success. Traders should determine their risk tolerance and set stop-loss and take-profit levels to manage potential losses and lock in profits, respectively.

4. Demo Trading

Exness offers a demo account feature that permits traders to practice without risking real money. This is an excellent way to test trading strategies, familiarize yourself with the platform, and build confidence.

Common Mistakes to Avoid

While trading can be lucrative, it comes with risks. Here are some common mistakes to avoid:

- Overleveraging: Using excessive leverage can magnify losses. It is vital to use leverage prudently.

- Chasing Losses: It can be tempting to trade impulsively after a loss, but this often leads to further losses.

- Neglecting Research: Failing to research and analyze before trading can lead to uninformed decisions.

Conclusion

Exness Forex & CFDs trading offers an exciting opportunity for traders looking to diversify their portfolios and engage in global markets. By understanding the basics of Forex and CFDs, leveraging the tools and resources provided by Exness, and adhering to sound trading strategies, you can enhance your chances of success. Remember to practice patience, continuous learning, and effective risk management as you embark on your trading journey.